A central concern of Ukrainian-Russian tensions has been Europe’s dependence on natural gas and oil imported from Russia. In 2019, roughly 40% of Europe’s natural gas was supplied by Russia. The EU imports 26.9% of its crude oil from Russia and 46.7% of solid fuel (eg. coal).

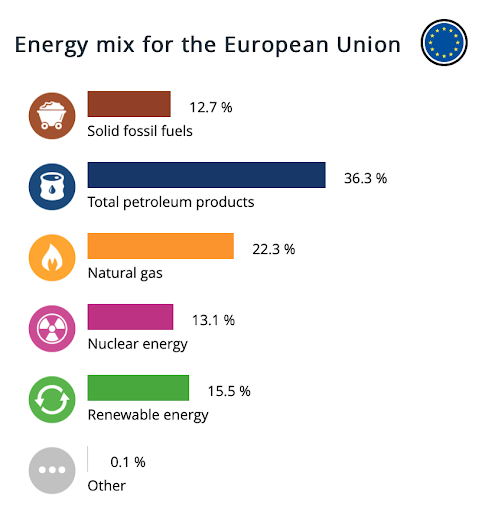

The EU’s energy sector in 2019 consisted of mainly, “Petroleum products (including crude oil) (36 %), natural gas (22 %), renewable energy (15 %), nuclear energy and solid fossil fuels (both 13 %).”

The main purchaser of natural gas has been Germany, which announced a halting of the Nord Stream 2 pipeline. Nord Stream 2 is a proposed 745-mile pipeline from western Russia’s border with Estonia to northeastern Germany via the Baltic Sea which would supply natural gas to central Europe. Consequently, Nord Stream 2 announced the dismissal of all of its 106 employees.

The timing of Russia’s invasion of Europe has been noted as significant because energy use is higher in the winter months, as people use gas to heat their homes.

Europe’s dependency on Russian imported energy increased following the declining production from the North Sea reserves. North Sea Energy, a public-private research program investigating the potential of an integrated energy system for the North Sea, hopes for a diversification in the region’s energy productions to foster wind energy, CO2 transportation and storage and hydrogen production.

As the conflict continues, Western companies are cutting ties with Russian companies and are using their reserves to supply energy. BP, Shell and Equinor have stated that they are exiting their Russian investments, while TotalEnergies, a French oil company, said it would no longer provide capital for new projects in Russia. Russia is now turning to China for its energy market transactions, marked by an agreement between Gazprom and China for a 30-year contract to supply gas to China.

At first glance, the abrupt ending of Europe’s reliance on Russian fossil fuels seems promising for a transition to a sustainable future. The European Commission’s 2030 Climate Target Plan aims to, “to cut greenhouse gas emissions by at least 55% by 2030 [and set] Europe on a responsible path to becoming climate neutral by 2050”. A faster change to renewable energy may just beat those targets.

However, it does not seem that Europe is ending its involvement with fossil fuels imminently, as countries across the globe are stepping up their supply of fossil fuels to Europe. South Korea offered the release of more of its oil reserves and is also considering the resale of LNG to Europe. Europe remains a top destination for American LNG tankers. Some people have floated the idea for Americans to collectively make an effort to use less energy and send the surplus to Europe to help the dilemma.

In response to the urgent need of European energy security, the Atlantic Council Global Energy Center, an organization that proposes policy choices and strategies to address global challenges, outlined possible solutions to the energy crisis which include investing in energy efficiency, delaying the closure of nuclear power plants, and accelerating renewable energy projects.

While the sudden necessity to end dependence on Russian oil, gas, and coal may spark hope of an accelerated transition to renewable energy sources within the EU, the availability of these fossil fuels from many nations including the US, South Korea, Azerbaijan, Nigeria, and many others suggests that the energy change may not occur much faster than the set EU targets. Still, the Russian-Ukrainian war has increased the pressure on European countries to be energy independent and hopefully a faster transition to renewable energy sources will be the result.

Sources: Eurostat, Wall Street Journal, and North Sea Energy